Investing opportunities await in the U.S. market.

Video

transcript

Investing in the U.S. market provides access to opportunities through global companies, ADRs, and ETFs, which could offer investors a wide range of benefits.1

Why invest in the U.S. market?

-

Capitalization

Together, the New York Stock Exchange (NYSE) and the NASDAQ comprise the deepest financial market in the world, with a market cap of over US$50 trillion.* This allows investors to own shares of the largest companies in the world, providing more choices and options for investors.

-

Liquidity

With the world's largest and most liquid market, you have less risk of market manipulation and a better chance of finding a small spread and a buyer or seller of any stock at any time.

-

Diversification

Diversify your portfolio beyond stocks with investments, including U.S. government bonds, corporate bonds, ETFs that cover different sectors and industries, and ADRs that represent shares in non-U.S. companies.

-

Market transparency

The well-established regulatory system of the U.S. securities market, set by the U.S. Securities and Exchange Commission (SEC), aims to protect against market manipulation and promote market efficiency, integrity, and investor protection.

-

Lower currency risk

The U.S. dollar is the dominant reserve currency and has historically been very stable, helping to mitigate the risk of fluctuating exchange rates.

-

Innovation

Many highly innovative companies have emerged in the U.S. market, a trait that often positions companies for strong growth and accelerated earnings.

Why choose Schwab for investing in the U.S.?

-

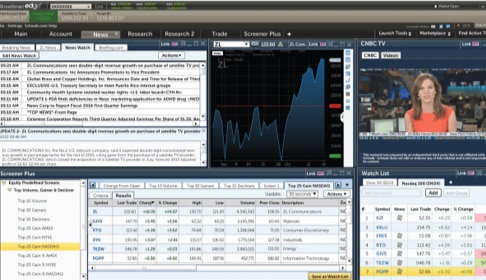

Powerful tools and platforms

Find, analyze, and act on opportunities with Schwab's innovative trading tools. See them in action.

-

Educational workshops

Join us for complimentary financial education and U.S. market insights. View upcoming events.

-

Professional guidance

Receive planning and investing guidance from our team of specialists. Discover what we can do for you.

Common questions

-

The Dow Jones Industrial Average (DJIA) is meant to be indicative of the overall U.S. economy and represents thirty large-cap, dividend-paying stocks. The DJIA differs from two other major U.S. stock market indices—the S&P 500 Index (SPX) and the NASDAQ Composite Index (COMP)—because it isn't weighted by market capitalization.

The low number of companies reflected can be seen as a drawback to the DJIA, as it's nowhere near the whole U.S. market. For a broader gauge of the U.S. equities landscape, some investors turn to the S&P 500.

-

The S&P 500 is a market index, or a hypothetical portfolio, representing the average value of the leading 500 companies traded in the U.S. stock market. The index is weighted by market capitalization ("market cap") and the number of shares traded for each company, so it's not a simple list of the 500 largest companies in the U.S. market.

The S&P 500 index was created by Standard & Poor's company, a credit rating agency, in 1957 and has become a popular measure of market performance for large U.S. publicly traded companies. Many view it as a good proxy for the performance of the U.S. stock market.

There are other popular market indexes in the U.S., like the Russell 2000, which tracks some 2,000 "small-cap" companies in the U.S. stock market. And the Dow Jones Industrial Average (DJIA) that tracks the thirty largest companies that trade on the New York Stock Exchange and NASDAQ.

Due to its diversity and depth, the S&P 500 index is viewed by many as the better measure of the performance of the largest publicly traded companies in the U.S. stock market.

-

No, at least not directly, because the S&P 500, like other indexes, is a measure of a hypothetical portfolio of companies. It's not a traded product, so investors interested in investing in the S&P 500 index can purchase funds that seek to replicate that index's behavior. Many funds do that quite successfully.

-

Every index comprises a set number of weighted stocks. But not all indices are weighted the same, which is something traders often overlook.

Take these three leading indices as an example: the NASDAQ 100, the Dow Jones Industrial Average (DJIA), and the S&P 500.

The NASDAQ 100—considered a tech index by many—consists of 100 non-financial companies. This index is "capitalization-weighted" (cap-weighted), meaning the component securities are weighted based on market cap (price times the number of shares outstanding).

The S&P 500 is also cap-weighted. The influence of this weighting means a handful of larger companies make up most of an index's total market cap. Not surprisingly, larger-cap stocks can have a significant impact on the index's movement.

The DJIA represents thirty large-cap, dividend-paying stocks. The index is weighted by price, making it an average of all its stock prices. (That's the total of all stock prices divided by the number of stocks.) Price weighting means that smaller companies can make up a larger percentage of the index but have a disproportionate influence.

-

Stay up to date on the U.S. market with U.S. Market Commentary, a constantly updated collection of insights and ideas from Schwab's market experts.

-

As a general rule, non-U.S. persons with no U.S. business operations are typically not obligated to file a U.S. tax return. You should consult your legal and tax advisor(s) with any questions. Here is some basic information about U.S. tax and estate considerations which can be taken into account as part of your investment decision-making process.

-

We provide access to the U.S. market to help international investors take advantage of investment opportunities with a variety of products, including:

- Stocks

- Exchange-traded funds (ETFs)

- Fixed income

- American depositary receipts (ADRs)

For investors looking for guidance, we offer investment advice that enables you to work one-on-one with a dedicated Schwab Financial Consultant on an ongoing basis to grow and preserve your wealth.

-

Schwab offers financial education specially designed for its international clients. Our live webinars are designed to help investors learn more about topics around U.S. investing. We also offer regular updates and insight into the state of the U.S. market. Use these resources to improve your investing knowledge and enhance your trading skills.

Start investing

-

Start investing in the U.S. market today.

Have more questions? We're here to help.

-

Call

CallNew customers

+852-2101-0511

Monday-Friday, 9:00 am to 6:00 pm (HK Time)Existing customers

+852-2101-0500

Monday 5:30 am – Saturday 1:00 pm (HK Time) -

Email

Email -

Visit us

Visit usCharles Schwab, Hong Kong, Ltd.

Room 3401, 34th Floor, Gloucester Tower,

The Landmark, 15 Queen's Road Central, Central, Hong KongOffice hours

Monday-Friday, 9:00 am to 6:00 pm (HK Time)