2025 U.S. Stocks and Economy Outlook

We've often chuckled at comments about "markets hating uncertainty"…as if there have ever been periods of certainty. But as we close the books on 2024 and peer into 2025, perhaps the uncertainties this time are of a magnitude beyond the norm.

For illustrative purposes only.

Good luck figuring this one out

President-elect Trump's policy proposals have always sparked intense debate, but the extreme uncertainties surrounding them—and the myriad associated crosscurrents—have made it difficult to forecast their impact on both domestic and global conditions. The ambiguity stems from several factors, including the fluidity of Trump's policy positions, his unconventional governing style, and the absence of detailed, consistent frameworks guiding his statements…not to mention his "policy by (social media) post" philosophy. It leaves with an outlook that can be summarized by: ¯\_(ツ)_/¯

But before getting into the details of what's been proposed and their impact, let's start with the basics of what happened with the election(s) outcome and what that has meant—at least historically. The table below puts the political power combination in the context of the stock market (Dow Jones Industrial Average), inflation (Consumer Price Index), economic growth (Coincident Economic Index) and debt-to-GDP levels. As shown, under the incoming configuration historically, market performance was decent and CPI decelerated; while economic growth was relatively muted and debt/GDP expanded slightly. At this point, our best guess is that market performance and economic growth could remain decent; but that inflation and debt/GDP may be biased higher.

Source: Charles Schwab, ©Copyright 2024 Ned Davis Research, Inc.

Further distribution prohibited without prior permission. All Rights Reserved. See NDR Disclaimer at www.ndr.com/copyright.html. For data vendor disclaimers refer to www.ndr.com/vendorinfo/, as of 12/6/2024. DJIA=Dow Jones Industrial Average. CPI=Consumer Price Index. CEI=Coincident Economic Index. *Publicly held federal Debt/GDP expressed as annualized point change. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

The specifics

Trump campaigned on a platform of lower taxes and less-stringent regulations—seen as growth-positive—but also higher tariffs on imported goods and mass deportations of illegal immigrants—seen generally as stagflationary, at least initially. These crosscurrents and the uncertainties they are breeding make it difficult for stakeholders (both domestic and international) to plan for the future; potentially creating an environment of caution and concern across policy areas. Add to this a Federal Reserve operating in data-dependency mode, and we have a backdrop of reactionary market behavior and policy decisions.

There has been a paper from the Peterson Institute for International Economics (PIIE) being widely circulated, covering a copious amount of research associated with the implications of Trump's proposed policies. The table below is a summary of some of those expected impacts. It includes two levels of deportations, the lower of which references Trump's desire to model his administration's deportation efforts after "Operation Wetback"—a 1956 campaign under the Eisenhower administration that deported 1.3 million people—while the other references what Trump believes are the 8.3 million unauthorized immigrants currently in the U.S. workforce. It also includes the proposed 10% increase in tariffs on all trading partners and the proposed 60% increase in tariffs on imports from China; while also including estimates under retaliation scenarios. In sum, it's a lower growth / higher inflation set of scenarios.

Source: Charles Schwab, Peterson Institute for International Economics (PIIE), as of 9/2024.

Forecasts contained herein are for illustrative purposes only, may be based upon proprietary research and are developed through analysis of historical public data.

"On" tariffs

Before getting into more detail on tariffs, let's get the basics out of the way. We often bristle at the short-hand typically used when describing tariffs; including headlines like "tariffs on China" or the United States wants to "charge Mexico and Canada" with additional tariffs. We know what those headlines mean, but many people do not (which has surprised us many times). The U.S. company importing the tariffed goods pays the bill; the countries targeted do not pay the bill. Who ultimately bears the cost depends on myriad factors, including price elasticity, pricing power and the pass-through to consumers, retaliations by targeted countries, exchange rate changes, etc.

On the pro-growth side of the ledger are tax-related proposals (including the extension of 2017's tax cuts and the possibility of a further corporate tax cut). That's in addition to pro-growth deregulation policies being proposed. There may be a timing issue given policies around tariffs and immigration can largely be done via executive order, while tax changes require Congressional approval.

In terms of the combined effect of the proposed tax changes and tariffs, the PIIE chart below breaks down the expected impact on consumers based on income quintiles. As shown, higher income folks are set to benefit more from proposed tax policy changes, while lower income folks would be disadvantaged more from proposed tariff policy changes. The expected net effect is negative for all but the top 1% of incomes.

Policies' estimated costs

Source: Charles Schwab, Peterson Institute for International Economics (PIIE), Kimberly A. Clausing and Mary E. Lovely, as of 8/21/2024.

Proposed tariff estimates examine a 20 percent tariff for most goods, except for a 60 percent tariff on imports from China. The net effect bars show the combined net effect of the loss from proposed tariffs and the gain from TCJA (Tax Cuts and Jobs Act) extensions.

2018 playbook?

Although it's "always different this time," there is a tariff-related playbook being dusted off from 2018's trade war. As shown below, once tariffs initially kicked in, initiating the trade war, the divergent paths for tariff-impacted categories vs. non-impacted categories became stark in terms of inflation. What had been a generally-disinflationary trend for several years inflected in terms of the tariff-impacted categories—kicking in just before the tariffs were detailed. Overall inflation remained fairly low in the 2018 era, in part because the narrower list of tariff-impacted goods were mostly in the intermediate and capital goods categories, not in most consumer categories.

Divergent inflation paths

Source: Charles Schwab, Bloomberg, as of 12/31/2019.

Data indexed to 100 (base value = 2/28/2018). An index number is a figure reflecting price or quantity compared with a base value. The base value always has an index number of 100. The index number is then expressed as 100 times the ratio to the base value. Nine tariff-impacted categories include: Sewing, household appliances, furniture and furnishings, carpets and floor coverings, auto parts, household linens, motorcycles, sport and recreation vehicles, and household supplies.

This has already started to take a bite out of consumer confidence. In fact, within the University of Michigan's Consumer Sentiment Index, the percentage of respondents saying they're purchasing more large household durable goods because prices won't come down spiked this month to the highest since October 1981. Relatedly, trade-related policy uncertainty has spiked, as shown below. Using the 2018 playbook again, it's not a stretch to expect bouts of equity market volatility to kick in barring a retreat in uncertainty.

Trade policy uncertainty spike

Source: Charles Schwab, Bloomberg, as of 11/30/2024.

U.S. Trade Policy Uncertainty Index is one of the category-specific Economic Policy Uncertainty (EPU) indexes developed in "Measuring Economic Policy Uncertainty" by Scott R. Baker, Nick Bloom and Steven J. Davis. It reflects the frequency of articles in American newspapers that discuss policy-related economic uncertainty and also contain one or more references to trade policy.

Positive forces at play, too

Let's not be Debbie (or Donnie) Downers on all of this. The good news is that the past two decades have brought more sustainable and resilient growth in the domestic economy, and more self-sufficiency in terms of food and energy production; lessening the reliance on trade. This has led to higher returns on U.S. capital and in turn ample capital inflows alongside a strong U.S. dollar.

But there are other uncertainty wrinkles looking ahead; a key one being immigration policy. Regardless of your view about our immigration problem and appropriate solutions, unquestionably, slower immigration coupled with mass deportations will lead to a downshift in labor force growth and labor supply—also likely denting the economic demand side of that equation.

For now, the labor market remains healthy. The rise in the unemployment rate from 3.4% at the start of 2023 to its current 4.2% was largely a function of a significant increase in the labor force due to immigration—not due to layoffs. Assuming immigration falls and deportations pick up alongside a slowing in the labor force, the downward pressure on wage growth could reverse. That, plus a lower sustainable rate of payroll growth could put the Federal Reserve in a bit of a pickle trying to adjust policy to that downshift, especially if inflation heats up per the PIIE estimates above.

Some easing in recent bifurcations?

Before the results of the election, we were assuming there would start to be some convergence in what has become a yawning spread between goods-oriented and services-oriented inflation readings. Shown below, since the epic high in 2022 of core goods inflation, it's now in deflation territory. On the other hand, core services inflation remains sticky on the high side. Overall, we expect core inflation (especially of the CPI variety given its higher shelter weight) to remain somewhat sticky with possible upside associated with both policy risk and the fact that the economy is operating with limited slack.

That is a distinctly different backdrop relative to the 2018 trade war period, during which overall inflation remained tame. As Kathy Jones detailed in her fixed income outlook, another difference relative to 2018 is the wider federal budget deficit and bond market sensitivity to those trends. As regular readers know, we have had the view that we're in a secular backdrop of likely higher inflation volatility, driven by heightened geopolitical tensions, increased protectionism, climate change and elevated government debt levels.

Goods vs. services convergence?

Source: Charles Schwab, Bloomberg, Bureau of Labor Statistics, as of 10/31/2024.

Another expected convergence, seemingly already underway, might develop a wrinkle or two associated with upcoming policy decisions—especially regarding trade. As shown below, we have recently seen a turn lower in the services side of the economy, as measured by the Institute for Supply Management (ISM); while the long-beleaguered manufacturing side of the economy may be finally starting to perk up. For some historical perspective, however—and again bringing in the 2018 playbook—at the start of 2018's trade war, there was an immediate deterioration in the economy, especially for manufacturing. Although services ultimately came along for the ride down, that was pandemic-related, not trade war-related.

Can manufacturing play catchup?

Source: Charles Schwab, Bloomberg, as of 11/30/2024.

Recent strong performance of cyclical stocks relative to defensive stocks points in the direction of a continued pick up in manufacturing activity, per the historical relationship shown below. Conversely, if cyclicals were to begin underperforming defensives, it might suggest a stall in the hoped-for manufacturing recovery.

Notable cyclicals outperformance

Source: Charles Schwab, Bloomberg, as of 11/30/2024.

GS (Goldman Sachs) cyclicals vs. defensives ex-commodities is a custom basket pair trade that represents going long U.S. cyclicals and short U.S. defensives. Performance reflects each side rebalanced back to equal notional at the close of each trading day. a Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance does not guarantee future results.

Potentially laborious labor policy

In addition to tariffs, the other major policy to consider in 2025 is that of labor and immigration. Again, there is little we can glean at this point, given the lack of clarity when it comes to timing and the scope of both migrant inflow restrictions and deportations. However, what we do know—based on history—is that growth in real GDP and the labor force tend to move in tandem. As shown below, the rolling five-year changes in both are quite tight. In keeping with the aforementioned estimates from PIIE, we see the potential for slower growth if significant deportations take place.

Restricting labor growth hurts GDP

Source: Charles Schwab, Bloomberg, as of 9/30/2024.

Of course, mass deportations could prove to be a logistical challenge and take some time to implement; a slow process would likely be less damaging. The reality, though, is that the labor market has become more dependent on immigrants since the first Trump administration. Foreign-born individuals have accounted for nearly all U.S. labor force growth over the past four years, so it's logical to anticipate a material slowdown coming down the pike if a good chunk foreign labor is eventually removed.

Another dynamic that has changed relative to Trump's first term is the trend in the unemployment rate. While it is down a bit from its recent July high, it isn't in a multiyear downtrend like it was in early 2017. In addition, the percentage of small businesses planning to ramp up hiring has fallen considerably over the past couple years (note: the series is inverted). That suggests there might still be some room for the unemployment rate to move higher.

Small businesses bearish on labor

Source: Charles Schwab, Bloomberg, Bureau of Labor Statistics, NFIB (National Federation of Independent Business), as of 10/31/2024.

Right y-axis truncated for visual purposes.

There might be some volatility in store for small business attitudes, though. As shown in the chart below, there has been a recent, strong climb in their outlook for business conditions, much of which might be tied to the election. Admittedly, this series has been increasingly driven by politics over the past decade—shown via the significant surge in late-2016 and significant decline in late-2020—but it's worth noting that despite the 2016 bounce, optimism faded sharply as the U.S.-China trade war heated up in 2018. We wouldn't rule out a hit to confidence if trade tensions ratchet up significantly again.

Small businesses, bigger confidence?

Source: Charles Schwab, Bloomberg, National Federation of Independent Business (NFIB), as of 10/31/2024.

We also wouldn't rule out a longer recovery time in housing affordability, especially if tariff policy raises the cost of materials and aggressive immigration policy reduces the availability of labor in the construction industry. The combination of higher mortgage rates, record-high home prices, and relatively low housing supply pushed affordability to multidecade lows in 2024. If the Fed is not able to cut rates in 2025 as much as originally anticipated—thus keeping upward pressure on mortgage rates—we see that slowing the recovery in housing affordability. That would be exacerbated by labor shortages driven by the removal of construction workers.

A slower affordability recovery

Source: Charles Schwab, Bloomberg, National Association of Realtors (NAR), as of 9/30/2024.

Stocks: A choppier ride above the surface

Transitioning to the stock market, we think overall that equities can do well from point A (the beginning of the year) to point B (the end of the year). However, the volatility backdrop is likely to be different from what investors got used to in 2024. This past year was defined by incredible sub-surface churn with minimal relative scarring at the index level: the maximum drawdown for the S&P 500 was -8.5%; the average member's maximum drawdown was -20%. The likelihood of a similar dynamic in 2025 is low, in our opinion.

Starting with where we are now, though, the market is in a relatively healthy position. As shown in the chart below, the S&P 500 is comfortably above its 50- and 200-day moving averages (DMAs); and when its 50 DMA was above its 200 DMA historically, the average annualized gain for the index (going back to the late 1920s) was 9.2%. There is strong momentum heading into the new year.

"Don't fight the tape"

Source: Charles Schwab, Bloomberg, ©Copyright 2024 Ned Davis Research, Inc.

Further distribution prohibited without prior permission. All Rights Reserved. See NDR Disclaimer at www.ndr.com/copyright.html. For data vendor disclaimers refer to www.ndr.com/vendorinfo/, as of 12/6/2024. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

That might be an understatement given, at the time of this report's publishing, the S&P 500 has logged 57 record highs this year. That puts it on pace with 2021, 2017, and 1995, to name a few historical instances. It's normal to see this in the early years of a bull market, but investors might need to dampen expectations when it comes to another year of record gains. As shown in the accompanying table below, when the number of record highs exceeded 35 historically (which is the case in 2024), the S&P 500's median gain in the following year was 5.8%. That isn't anything to scoff at and, if anything, is indicative of a bull market that continues to mature. We'd note, though, that the number of cases in which the market was higher the following year was just nine.

Many records today, maybe fewer tomorrow

Source: Charles Schwab, Bloomberg, ©Copyright 2024 Ned Davis Research, Inc.

Further distribution prohibited without prior permission. All Rights Reserved. See NDR Disclaimer at www.ndr.com/copyright.html. For data vendor disclaimers refer to www.ndr.com/vendorinfo/. 1928-12/6/2024. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

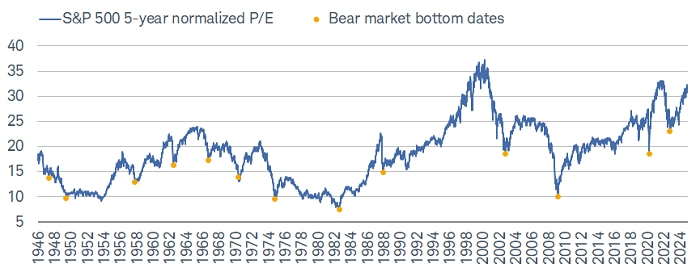

One of the reasons for a step back in performance after such a strong year might be tied to multiple expansion getting long in the tooth. Shown below is the S&P 500's 5-year normalized P/E, which comes from our friends at the Leuthold Group. One of our favorite valuation metrics, it uses four-and-a-half years of historic earnings and two quarters of estimated earnings; and in addition, it takes the mid-point between reported and operating earnings. The S&P 500 is looking quite stretched, and in fact has only been more expensive in the late 1990s and 2021—of course, periods which preceded weakness in the market.

Multiples have multiplied

Source: Charles Schwab, The Leuthold Group, as of 11/29/2024.

Normalized P/E uses five-year average earnings (18 quarters of historical results combined with two quarters of future estimates). Past performance is no guarantee of future results.

In keeping with our maxim that valuation is more of a sentiment indicator (or indicator of sentiment), we think the stretched valuation environment is a product of enthusiasm around equities. Yet, it's hard to argue that high multiples in and of themselves represent a risk to the market's near-term performance. Multiples can continue to move higher (as was the case in the late-1990s) and there isn't a strong historical relationship between valuation and forward performance.

As shown in the chart below, the correlation between the S&P 500's forward P/E and subsequent one-year performance—going back to the 1950s—is -0.11, which means there is virtually no relationship. Perhaps less important is the correlation and yellow line; more important is the range of outcomes, such as two opposite instances in which the forward P/E was 25, but in one case was followed by a ~30% decline the following year and in another case a ~45% increase in the following year.

Valuation a terrible market-timing tool

Source: Charles Schwab, Bloomberg. 1958-11/30/2024.

Correlation is a statistical measure of how two investments have historically moved in relation to each other, and ranges from -1 to +1. A correlation of 1 indicates a perfect positive correlation, while a correlation of -1 indicates a perfect negative correlation. A correlation of zero means the assets are not correlated. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

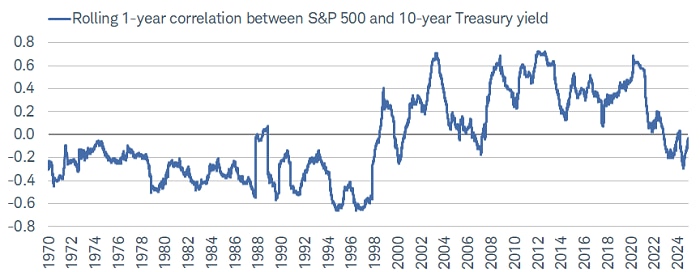

Rather than valuations being a driver of stock performance next year, we think there is potential for bonds to (again) be more influential, especially if inflation proves to be stickier and/or more volatile. As shown below, the rolling one-year correlation between changes in the S&P 500 and the 10-year Treasury yield climbed back towards zero in the latter part of this year, which has—all else equal—been a relief to equities. Should that continue into 2025, that could put the market back in a favorable position as it pertains to the relationship with inflation. However, if inflation volatility picks back up, which will become clearer after tariff and labor policy implementations, there could be more risks to stocks via bonds.

Bonds potentially back in driver seat

Source: Charles Schwab, Bloomberg, as of 12/6/2024.

Correlation is a statistical measure of how two investments have historically moved in relation to each other, and ranges from -1 to +1. A correlation of 1 indicates a perfect positive correlation, while a correlation of -1 indicates a perfect negative correlation. A correlation of zero means the assets are not correlated. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

Small caps lock?

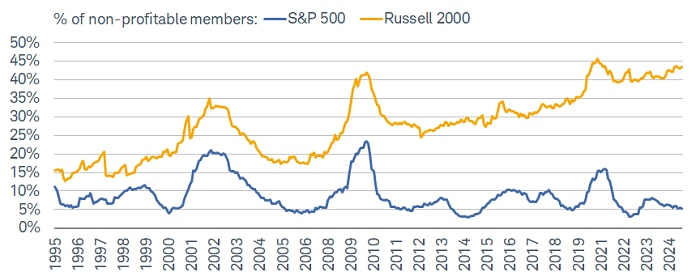

Naturally, a discussion of interest rates leads to a look at small caps. One of the reasons we think small caps have struggled in the current bull market (and bear market that preceded it)—until recently—is because of the sharp increase in rates—not least because smaller companies are more exposed to floating-rate debt. They also have weaker profit profiles, as shown below. Through the end of November, nearly 45% of Russell 2000 members were not profitable on a trailing 12-month basis; compared to only ~5% for the S&P 500.

Smaller companies, fewer profits

Source: Charles Schwab, Bloomberg, as of 11/30/2024.

Profitable companies have trailing 12-month earnings per share greater than $0. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

With that large of a chunk of the index lacking profits, it's understandable why small caps shouldn't be looked at as a monolith. In fact, separating the index using profitability as a sole factor is one way to see that some small caps have indeed done quite well in this bull market. As shown below, since the start of the S&P 500's bull market in October 2022, the profitable members in the Russell 2000 are up by 45.2% (on average). That compares to a much weaker 22.1% gain for the non-profitable group.

Profits lead to outperformance

Source: Charles Schwab, Bloomberg, as of 12/6/2024.

Profitable companies have trailing 12-month earnings per share greater than $0. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

We think there are reasons to be constructive on profitable small caps, especially if economic growth continues to hold up throughout the year and the Fed takes a slow, methodical approach to rate cuts. At the index level, though, there might continue to be frustrating surges and subsequent reversals for the Russell 2000 if earnings growth doesn't improve. As shown in the chart below, forward 12-month EPS estimates have been trending lower for the past few years; and if trade policy disruptions weigh on profit expectations—as was the case in 2018-2019—then there could be limited upside for small caps relative to large caps.

Profits favor large caps

Source: Charles Schwab, Bloomberg, as of 12/6/2024.

Data indexed to 100 (base value = 12/6/2014). An index number is a figure reflecting price or quantity compared with a base value. The base value always has an index number of 100. The index number is then expressed as 100 times the ratio to the base value. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

It's bananas

Before wrapping up, it behooves us to consider the investor sentiment environment heading into 2025. There are significant pockets of froth evident in segments of the market, including the art market. $6.2 million for a banana that's already been eaten, secured by duct tape? That's a bit absurd. Other hallmarks of some speculative frenzy include the crypto space (including a number of obscure new coins) and massive retail investor flows into leveraged single-stock exchange-traded funds (ETFs) and zero-days-to-expiry options.

Looking at flows more broadly, shown below is the move above the two standard deviations line in equity ETF flows; including a record-breaking month of November for inflows.

Flows on fire

Source: Charles Schwab, Strategas, as of 12/6/2024.

ETF=exchange-traded fund. Standard deviation is a measure of the extent to which numbers are spread around their average. Past performance is no guarantee of future results.

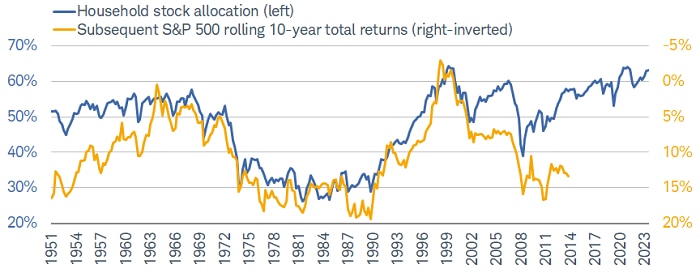

Households are also holding a near-record share of their assets in equities, per the data shown below. That doesn't prevent more momentum in the near-term, but longer-term enthusiasm should be tempered with regard to expected returns over the next decade (per the yellow line below), assuming the historical connection remains tight.

Households loaded with stocks

Source: Charles Schwab, Bloomberg, ©Copyright 2024 Ned Davis Research, Inc.

Further distribution prohibited without prior permission. All Rights Reserved. See NDR Disclaimer at www.ndr.com/copyright.html. For data vendor disclaimers refer to www.ndr.com/vendorinfo/., 12/31/1951-6/30/2024. Equity allocation (includes mutual funds and pension funds) is % of total equites, bonds and cash. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

Much like with valuation, although frothy sentiment should be considered a contrarian indicator, it should not be considered a market timing tool. What it does suggest is that if a negative catalyst were to appear, there could be more downside risk given both frothy sentiment and already-lofty allocations to equities.

Recommendations

We never try to time markets as it's a fool's errand. We do try to provide guidance and a sense of direction. Market momentum and breadth conditions tend to bode well for returns over a 12-month time horizon. During the past seven decades, there have been only two bull market peaks that occurred when the trailing one-year gain in the S&P 500 was above 30%, as is the case now. But most historical studies do point to heightened risk of volatility spikes and periodic drawdowns, which is why discipline is warranted.

From a sector perspective, Schwab does publish what we call "Sector Views," where you can see the latest array of ratings. We do continue to recommend a factor-based overlay to sector-based strategies. Factor is another word for characteristic and what we believe will continue to occur in 2025 is that performance at the factor level will be more consistent than performance at the sector level. Like in the second half of 2024, sector rotations could continue to be fierce—including in-and-out of popular segments like the Magnificent 7 group of mega-cap tech/tech-related stocks.

We continue to recommend staying up in quality at the factor level; emphasizing factors like profitability trends, balance sheet strength, ample interest coverage and healthy free cash flow. A subtle difference we might see next year is from "level" to "change" in terms of factors. In other words, we may be shifting from a "strong vs. weak" environment in 2024 to a "better vs. worse" environment in 2025; still associated with quality factors, but with inflection points and rates of change being more important. That means investors might be better suited in screening for companies or industries with (to name a few) improving profit, return on asset, return on equity, or free cash flow growth trajectories.

In sum

To borrow something our founder, Chuck Schwab, is fond of saying, "investing by nature is an act of optimism." We remain optimistic, but we also need to be risk-mindful, especially in a year with so many crosscurrents at work regarding policy. More to come from us as the year begins, but in the meantime, we are so grateful for our readers and followers and wish everyone a wonderful holiday season and a very Happy New Year.